Introduction:

Everything written here is subject to probability. Since we are not closed to any of the big money forces that drive the market, and since no one can predict the future, we can only watch carefully the footsteps of the big forces by the prices and the volume and to estimate directions and targets wherever possible (sometimes it is not possible at all and we need to wait patiently for another clue in the puzzle)

Nikkei225 (Futures):

Long term (the NK225 index) :

- Since there isn’t a long term chart for the Future contract, the long term view and levels are based on the Index rather than the Future contract, but the levels can be matched.

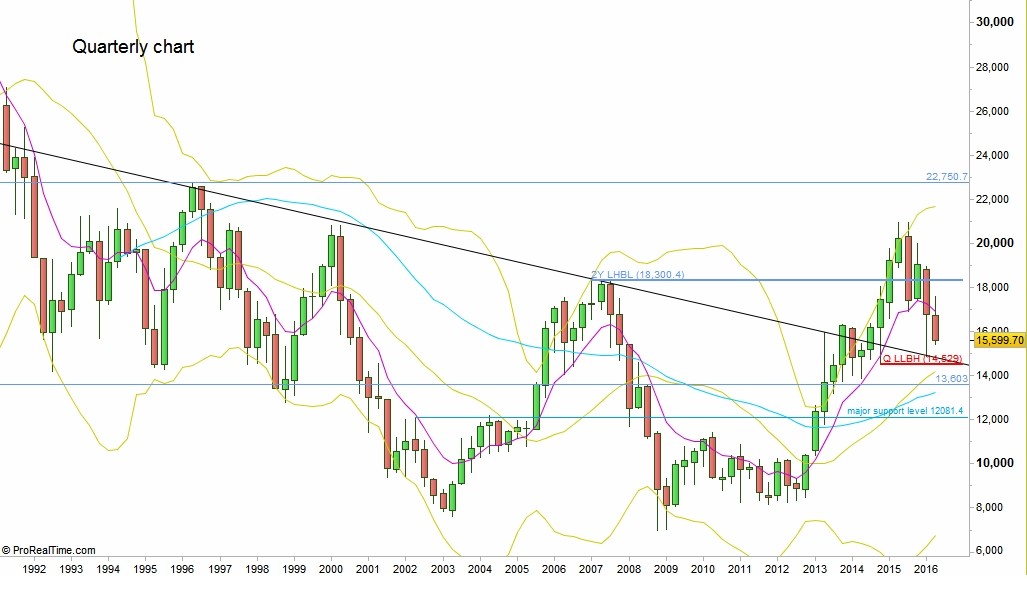

The most interesting long term chart for the Nikkei225 index is the Quarterly chart.

An important down trendline can be seen clearly, a trendline the market has already broken up taking out a very important level, the 2 Year LHBL (Last High Before Low), and the last quarters are currently a correction move to test it from above (a lockup).

The most important level currently is the Quarterly LLBH (Last Low Before High) at 14529. Taking out this level is an important sign of weakness and the price should most likely continue within the same bearish momentum to the support level at 13603, converging with the Quarterly 50 SMA (blue). A major support level is at 12081.4. This support level should most likely start another Quarterly pullback up (hasn’t started prior to that).

Further bearish signs later (e.g. transforming this pullback into a right shoulder might drop the market below 2008’s Low at 6994.

On the other hand, a Quarterly reversal up without taking out the Low (14529) should take the market to the next High to be achieved, at 22750.

Nikkei225 Index, Quarterly chart (at the courtesy of prorealtime.com)

Short term (Continual NK225 Futures):

On the Daily timeframe, the Q LLBH can be watched at 14400 for the continual contract.

The market has failed in taking out the last important High of 17940 (the failure is at point A), then pay attention to the Harmonic pattern AB=CD started after this failure. Since we’ve reached its target, it gives a good probability for a bounce up from the current levels to the next resistance levels.

Also, it is very important to notice the amplitude of BC that points near the Quarterly LLBH at 14400 (Orange ruler).

Next major support and resistance levels are mentioned.

Nikkeu225 continual Futures, Daily chart (at the courtesy of prorealtime.com)

Disclaimer :

My opinions are based on price action only, estimating which force (buyers or sellers) is in control at the moment. Markets can change behavior instantly due to new input/estimations/news/events.

Opinions expressed herein are my current opinions as of the date appearing in this material only and are subject to change without notice by further price action of the market. Any of the assumptions used herein do not prove to be true, results are likely to vary substantially. All investments entail risks. There is no guarantee that current price action will achieve the desired results under all market conditions and each investor should evaluate its ability to invest for the timeframe mentioned in the review and to accept the risk involved. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those discussed.

I will not have any liability for any damages of any kind whatsoever relating to this material.